How to improve your Cash Conversion Cycle

July 18, 2023 •Neale Lewis

.png?height=630&name=Scaling%20Up%20Blog%20Image%20-%20Cash%20(Green).png)

In the challenging journey of managing and scaling up a business, understanding your Cash Conversion Cycle (CCC) can provide key insights into your financial health, and notably, your cash flow. Cash is the oxygen that fuels growth and the CCC is a key performance indicator that measures how long it takes for a pound spent on anything ( Rent, Marketing , Payroll, etc ) to make its way through your business and back into your pocket

It's a metric that quantifies the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

To lay a foundation, let's define the CCC: It is calculated as the Days Sales Outstanding (DSO) plus the Days Inventory Outstanding (DIO), minus the Days Payables Outstanding (DPO). In layman's terms, it measures how long it takes a company to turn its inventory into sales and its sales into cash, offset by how long it takes to pay its suppliers.

So, how can a shorter CCC improve your cash flow, especially in a fast-growth organisation? Let's explore this concept further.

Fast-growth organisations, by their very nature, often find themselves in a precarious position with cash flow. With rapid expansion, the need to invest in inventory, hiring, marketing, and R&D intensifies. Yet, the return on these investments doesn't materialise immediately, creating a cash flow gap. A shorter CCC helps bridge this gap. The faster you convert your stock into sales, and sales into cash, the quicker you'll have cash in hand to fund your growth operations.

Amazon, for instance, famously operates with a negative CCC. As reported by The Wall Street Journal in 2020, Amazon generally collects cash from its customers before it pays its suppliers, effectively financing its operations with other people's money. This astute financial strategy has played a significant role in Amazon's aggressive growth.

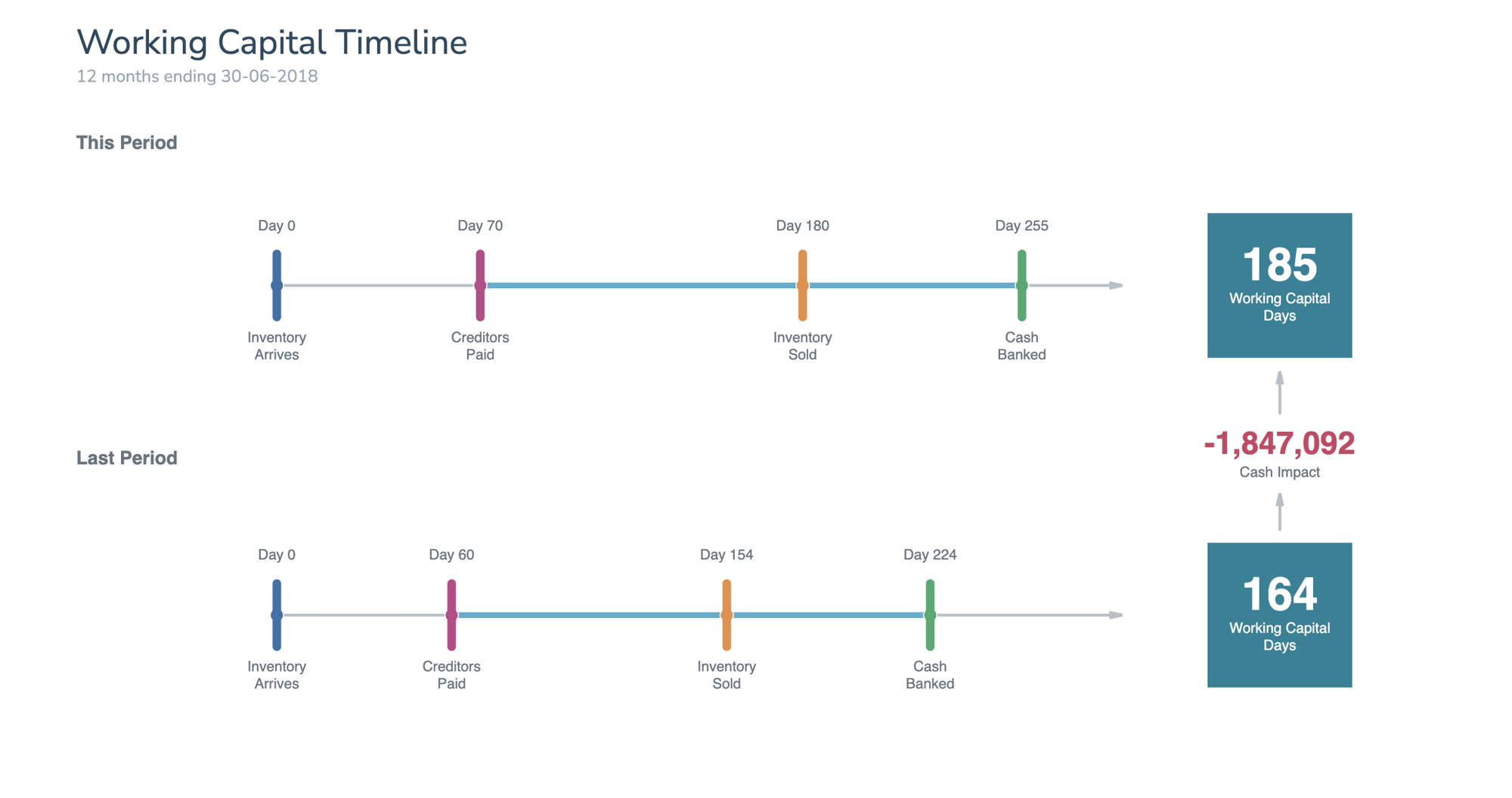

Using the Cashflow Story software we are able to help organisations improve their working capital position and their cash position by focusing on turning sales into cash, managing the stock position and getting customers to pay more quickly. The example below demonstrates what happens when we have taking our eye of the ball and the cash impact for a £40m revenue company when it has allowed its working capital dats to grow from 164 days to 185 days, meaning it has a negative cash impact of £1.85m.

So, how can you reduce your CCC and improve cash flow?

Firstly, reduce your DSO. How quickly are you turning your sales into cash? Investigate whether you can expedite this process. Consider offering early payment discounts or enforcing stricter payment terms. Dell, for example, implemented a direct sales model in the early 1990s, allowing it to collect payments upfront and substantially reducing its DSO (Business Insider, 2018).

Secondly, decrease your DIO. Are you holding onto stock too long? Using lean manufacturing processes, just-in-time inventory management, and efficient supply chain strategies can help. Toyota is a classic example, where their just-in-time strategy not only reduced costs but also decreased their DIO significantly (Harvard Business Review, 1996).

Lastly, increase your DPO. Can you negotiate longer payment terms with your suppliers? This needs to be handled carefully, though, as pushing out payments too far might strain your supplier relationships. P&G took an innovative approach by offering its suppliers supply chain finance options, allowing them to get paid sooner while P&G extended its payment terms, increasing its DPO (Supply Chain Dive, 2020).

Remember, each organisation is unique, and what worked for Amazon, Dell, Toyota, or P&G might not work for you. Therefore, I pose these reflective questions: How can you adapt and apply the principles of CCC to your specific situation? What steps can you take today to start improving your cash flow by optimising your CCC?

Cash management, especially in fast-growth organisations, is both an art and science. Understanding and leveraging your CCC is a powerful tool in your financial management toolbox. Keep an eye on your CCC, tweak it, and see your cash flow improve, helping you sustain and fuel your growth effectively and efficiently. Remember, cash is king - and the CCC helps you wear the crown wisely.

.png?width=2000&name=Neale%20Lewis%20-%20Blog%20Signature%20(3).png)